News & Events

BPA in the News

Financial Literacy Creates a Better Future

Written by Z.D.

The COVID-19 pandemic began earlier this year as a public health crisis, but quickly morphed into a mental health and economic crisis. Events caused by the pandemic – employees working from home, furloughed, laid off or forced to work on the front lines – pulled back the curtain on the lack of financial preparedness many Americans are facing.

In April, unemployment rates reached the highest level since the Great Depression. As a result, claims for unemployment benefits rose dramatically. However, millions of people who lost their jobs were unable to apply for this benefit. Still, these figures do not reveal the extent to which American families are struggling financially as a result of COVID-19-related job loss.

Read the full article in Building Trades News' October issue.

What to Know Before Open Enrollment

Source: Z.D.

While few things have remained certain in 2020, one event that will continue as planned is open enrollment — the period when you’re able to change your health plan for the upcoming year.

Timelines vary, but most HR departments hold open enrollment for a few weeks between October and December. During your open enrollment period, you’re able to select your health care coverage for Jan. 1 through Dec. 31, 2021. If you miss the deadline, you’ll typically remain with your current health plan until next year’s open enrollment period — that is, unless you change jobs or have what’s known as a qualifying life event, such as getting married or having a child.

While it might feel overwhelming, the choice you make can have a big impact not only on your health, but on your finances as well. Here’s what to know before open enrollment so you can make the decision that’s right for you and your family.

Read the full article on Northwestern Mutual.

Differences Between a Furlough and a Layoff

Source: Z.D.

Downsizing your company is never easy, especially in times of financial hardship. Employee salaries are one of the highest overhead costs for businesses, though, so furloughing or laying off employees may be your best (or only) option in a financial crisis. Before going down this path, you should understand the differences between furloughs and layoffs to determine which is the better solution for your business.

Read the full article on Business News Daily.

Learn the differences between FSAs, HRAs and HSAs to determine which is best for your business.

Source: Z.D.

When you're creating a competitive benefits plan for employees, good healthcare options should be a top priority. In addition to health, dental and vision insurance, many employers choose to offer employees supplemental tax-free accounts that can be used to pay for medical costs, such as flexible spending accounts (FSA), health reimbursement accounts (HRA) and health savings accounts (HSA). Although the purposes of these accounts are similar, there are a few key distinctions that will determine which one is right for your company.

Read the full article on Business News Daily.

The Power of Organized Labor

Written by Z.D.

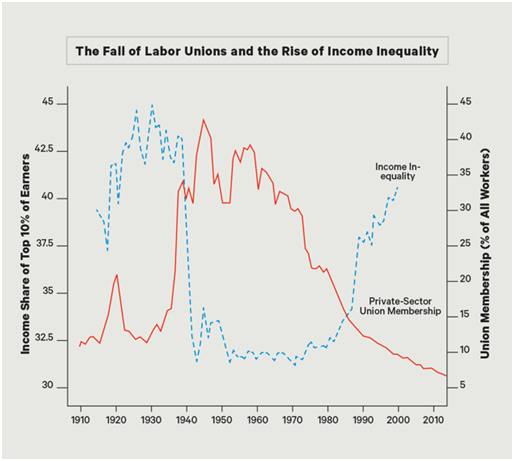

This year, more than ever, it is important to celebrate Labor Day. This holiday pays tribute to the contributions and ingenuity of American workers. While it traces its origins to well before the Industrial Revolution, organized labor and unions are as relevant and necessary as ever before, constantly adjusting to new challenges and in recent times, facing down the odds with renewed resolve. It is worth asking whether the systematic erosion of organized labor seen these last 25 years, and its undoubted erosion of communal society, has left us in a weaker position as we battle against COVID-19.

Labor unions have been part of the American landscape since the nation’s founding, with the formation of the Federal Society of Journeymen Cordwainers (Shoemakers) as early as 1794 in Philadelphia. However, much of the serious work of organized labor came into effect after the Civil War, with the National Labor Union formed in 1866 precisely to convince Congress that the number of hours worked in a week needed regulation. As industries changed from household craftsmen to mechanized factories, the market expanded beyond local boundaries and new levels of supply and demand determined an expanding economy.

Read the full article on Building Trades News: Labor Day Issue.

An Update on COVID-19 Assistance: Presidential Executive Orders

Recently, President Trump signed one executive order and three executive memoranda with the promise to provide additional assistance to Americans hurting financially from the COVID-19 pandemic. But from halting evictions to pausing payroll taxes and providing additional unemployment benefits, what do these executive actions accomplish?

A $400 Unemployment Benefit

Under the recent executive memorandum, the federal government would contribute $300 of the $400 payment allocated. This is down from the $600 allocated in the CARES Act passed in March, which ended July 31. Individual states, already under financial stress due to the coronavirus outbreak, are responsible for the remaining $100 per person per week, retroactively starting Aug. 1.

Eviction Bans and Relief

The executive order leaves the decision to ban evictions to Health and Human Services Secretary Alex Azar and Centers for Disease Control and Prevention Director Robert Redfield, taking no official stance itself. It also doesn't say if it will provide financial assistance to renters, leaving that decision to Mnuchin and Housing and Urban Development Secretary Ben Carson.

Student Loan Deferral Extension

The White House's memorandum on student loan deferral moves to waive student loan interest until December 31, extending current relief under the CARES Act that is set to expire September 30 by two months. Payments are scheduled to restart on January 1, 2021. The executive memorandum applies to loans "held by the Department of Education," which doesn't include privately held student loans, such as through a bank.

So far, the executive actions will cover only the four topics above, rather than the large scope of either party’s stimulus proposals negotiated in Congress. The executive orders are also not bills signed into law and can only do so much on their own. The executive orders did not address the following:

- • Testing, tracing and treatment of COVID-19

- • Money needed to safely reopen schools and provide personal protective equipment

- • Food assistance

- • Aid for local and state governments

- • Money ensuring that elections can be safely carried out

- • Money to keep post offices open for elections

Both parties note that it is possible for talks of COVID-19 relief legislation continuing. If talks resume, stimulus legislation could come to a vote in one chamber later this month, but both chambers must vote before the legislation goes to the White House for the president’s signature. If a deal is reached in the coming weeks, it's also possible that the executive actions will be null and void.

As negotiations continue in Washington, BPA will continue to monitor developments and provide updates to our members. Stay tuned to our website for more details.

CARES Act Benefit Assistance

The Coronavirus Aid, Relief, and Economic Security Act (the CARES Act) authorizes more than $2 trillion to battle COVID-19 and its economic effects, including immediate cash relief for individual citizens, loan programs for small business, support for hospitals and other medical providers, and various types of economic relief for impacted businesses and industries.

Many benefits remain available through the end of the year and beyond to mitigate the impact felt by the pandemic, while negotiations are still in the works to provide extension of relief, such as the federal unemployment benefit. Check with your state to learn more about potential changes to state unemployment benefits.

Below is a roundup of benefits still available to both employees and employers via the CARES Act:

Student Loans

All payments of principal and interest for certain federal student loans are suspended. The suspended payments are treated as if made for consumer credit reporting. The CARES Act also waives or modifies requirements with respect to the receipt of federal education grants, and allows deviations in the use and distribution of such grants. Further, provisions are made for students who have withdrawn from school or relocated due to the COVID-19 crisis.

Student Loan Repayment-Employee Education Assistance Program

Employers may provide a student loan repayment benefit to employees on a tax-free basis of up to $5,250 annually towards an employee’s student loans. The cap takes into account both any new student loan repayment benefit as well as other educational assistance currently provided by the employer. The provision applies to any student loan payments made by an employer on behalf of an employee after March 27, 2020, and before January 1, 2021.

Retirement Plan Relief

The CARES Act provides for additional relief for individuals with respect to distributions and participant loans under defined contribution plans. More detail is provided below under the heading Retirement and Other Employee Benefit Plans Relief.

Federally Backed Mortgages

Borrowers under federally backed family mortgages may submit a forbearance request if they are experiencing financial hardship due to the COVID-19 crisis. The lender must grant the request, without penalties, fees or interest, for a period of up to 180 days (subject to another 180-day extension at borrower’s request). Foreclosure action is prohibited for the 60-day period beginning March 18, 2020. Multi-family borrowers (assets designed for occupancy of 5 or more families) are entitled to forbearance and foreclosure protection on slightly different terms, and renters of such dwellings are provided eviction protection.

Retirement and Other Employee Benefit Plans Relief

The CARES Act provides additional relief with respect to distributions and participant loans under defined contribution plans, funding relief for defined benefit plans and enhanced flexibility for health care options and tuition assistance. The deadline for amending retirement plans for these changes is the last day of the first plan year beginning on or after January 1, 2022. These provisions can be implemented immediately. What this means to you is that these provisions offer employees and employers additional options to address the potential financial hardships that arise as a result of the effects of COVID-19 and offer additional ways to access health care and prescriptions.

Minimum Required Distributions

The CARES Act temporarily waives the required minimum distribution rules for 2020 with respect to certain defined contribution plans and IRAs.

Coronavirus-Related Distributions

Individuals may take coronavirus-related distributions from qualified retirement plans of up to $100,000 without such distributions being subject to the 10% early distribution tax. Such distributions are subject to federal income taxation, which may be ratably spread over the three taxable year period beginning with 2020. An individual who takes a coronavirus-related distribution may repay the distribution to an eligible retirement plan during the three-year period beginning on the day after the date of the distribution. Repayments within the three-year period will result in the distribution not being subject to federal income taxation, or in the case that the income tax has already been paid, permit the individual to receive a refund of the previously paid federal income tax. An individual must satisfy certain requirements in order to qualify for coronavirus-related distributions.

Funding Relief for Defined Benefit Plans

Any required minimum contributions for a single employer defined benefit that are due during the 2020 calendar year are not required to be made until January 1, 2021, with accrued interest from the original payment due date to the actual payment date. Additionally, plan sponsors of defined benefit plans may treat the last plan year's adjusted funded target attainment percentage as the percentage applicable to plan years which include the 2020 calendar year for purposes of applying the funding-based limitation on shutdown benefits and other unpredictable contingent event benefits.

BPA continues to monitor the evolving situation with COVID-19 and will provide updates as they become available.

Essential Services for Essential Times

Written by Z.D.

The COVID-19 crisis has forced the adaptation of almost every industry and the transformation of millions of lives in the course of a few weeks. For some individuals, this change occured in the course of a single day. Lives were upended, regulations changed, and systems have been altered. However, advances in technology have allowed businesses to stay connected, maintain operations, and ensure the livlihood of the millions of customers they serve.

Remote work simply wasn't considered a viable option, especially in the benefits industry environment; however, the wider use of technological advancements has made the transition to a work environment broadly accessible from the remotest parts of the globe. Software systems allow secure access to documents and empower collaborative workforces. Communication, project management and time traking softward continue to grow smarter and keep teams connected while miles apart. Industries that were largely in-person, due to the sensitive nature of operations, now have the ability to confidently and confidentially conduct business in a manner that protects clients while ensuring business advancement.

Read the full article on HR.com

Employee benefits shouldn't just look good on a PR blurb. Here are the benefits that add value to your employees' lives.

It is important for companies to offer benefits and perks that attract, retain and impress employees. Zane Dalal, executive vice president of the Benefits Programs Administration, spoke with Business.com about finding benefits that add true value to your employees' lives.

The most important thing to do, he said, is to listen to your employees.

"I cannot stress this enough," he said. "Send out an officewide survey. Take down notes and suggestions from an all-staff meeting. Hearing directly from your employees is key when developing or redeveloping any benefits packages in the workplace."

Read the full story.

BPA Encourages Workplace Mental Health - Building Trade News

It’s no secret that a productive work environment stems from happy employees. For most Americans, a large part of their daily lives is spent at work. According to the Mental Health America advocacy group, less than one third of Americans are happy with their work. Not only does this decrease productivity from employees, but it also puts employees’ long-term mental health at risk. In order to improve productivity in your business, there must be an awareness and understanding of the workplace environment and how it can be adapted to promote better mental health for employees.

Read the full story.

How Technology is Shaping the Benefits Industry - February 28, 2020

For Employees

Online Employee Benefit Portals. These online portals are providing open communication and access for all benefits related questions. Information on current company policies, benefit forms, newsletters and all benefit related news exist in one place so employees can sort through them privately and securely at their own convenience. Benefits portals can also include sections for health care and financial literacy, a medical reference library or online health care advice.

Virtual Health Care. As society figures out new ways to reach people in remote locations and provide the best care to individuals across the country, no matter where they live, virtual health care is taking off. This benefit provides a tool for employees to have access to medical care in non-emergency situations, without having to visit a doctor in person. Conducting consultations via app, online portal or video conference allows employees to use the latest technology to resolve medical concerns almost immediately.

Growth of AI. The recent rise of artificial intelligence across the benefits industry has resulted in more customized benefit plans for employees, as well as better customer service and more streamlined troubleshooting. Artificial intelligence can now provide recommendations based on prior history and employee preferences. This technology also allows benefits providers and administrators to offer the best customer service by carefully archiving notes from previous conversations with representatives for reference, offering a stress-free experience to employees.

Rise of Apps. Keeping employees engaged while promoting healthier lifestyles at the same time may be answered with the use apps. Promoting health information through apps at an employees’ fingertips has gained popularity over the last five years. These apps allow employees to track their own personal health progress, get additional, personalized information and help them make decisions about their health benefits based on their current health status. Apps that are game-based platforms can also be used to drive specific behaviors via competitions, where employees can score points, badges, etc. for achieving certain health or wellness goals (e.g. attending regular health check-ups or quitting cigarettes).

For Employers

Streamlined Employee Benefits Administration. Employee benefits administration is likely the main concern for most organizations. With the advancement of technology in the benefits industry, human resources and benefits administration teams can access all employee data, view and analyze claims, make updates to the insurance policies, and use the accounting section and direct billing to further streamline administrative tasks.

Online Enrollment Platforms. As technology has evolved in the benefits industry, providing open online enrollment to employees has allowed the employee themselves to take control of their enrollment, give them ample time to consider options and relieve human resources and benefits administrators of enrollment tasks. Online enrollment is tightly connected to employee benefits online portals, where new employees can use existing data or input new data themselves, compare insurance plan options, and they choose to extend it to their families, for example, they do not need to include human resources or benefits administrators in the process. Consider utilizing an online enrollment if it fits the needs of your organization.

Data Storage and Analysis. Cloud storing of data, as well as a backup, is always a great idea; storing data in the cloud is secure – and is just as cost effective as much as the traditional printed way. However, benefits administrators can use data to improve current employee benefits plans. Programs that help measure the effectiveness of benefits plans by analyzing claims data or spikes in turnover can help companies better understand how their staff is using benefits packages, and what changes should be done to include benefits that are most important to the employees.

Simply consider these new options in technology as they are the way employee habits are trending in other sectors. At the end of the day, each organization should do what is best for itself and its employees.

Technology-powered service is what sets BPA apart. Our online User Portals improve collaboration and communications among trustees, participants, and the benefits professionals that serve them. With the advancement of technology ni the benefits industry, we have been able to provide top-notch customer service and streamlined benefits administration to all of our customers. Contact us to see how we can help serve you today.

Read the full story.

Organized Labor Struggles in the American South

On January 28, BPA Executive Vice President Zane Dalal was featured in a UnionTrack piece, "Why Organized Labor Struggles in the American South." Zane offers that younger generations may hold the key to revitalization, "Millennials are incredibly adaptable, and people think of them as this sort of vague group, yet they are activists and they're incredibly sure of what they want."

Read the full story.

Are You Prepared for 2020?

Anticipating the shifting political landscape in 2020, Benefit Programs Administration (BPA) is tracking the latest policy developments in Washington. We understand that these policies touch each part of our industry in a unique way and are working to understand the implications to better serve our customers.

The upcoming 2020 presidential race is growing closer and candidates have their own ideas on how to protect retirement in America, address the student loan crisis and reform the health care system.

Many candidates are discussing Medicare for all, a system that concerns many union members. Medicare for all moves every person from private, employer-sponsored health insurance over to a single-payer system. While some unions support the single-payer legislation put forth by Senator Bernie Sanders (I-VT), others are not so enthusiastic. Quality health care plans negotiated between unions and employers are traditionally very good plans, and many union members enjoy them.

Additionally, some candidates are discussing cancelling student loan debt. While this may or may not become a reality, it changes how employers are recruiting new talents and the retention of existing talent. Employers who offer student loan repayment as a benefit may need to alter their plans to appeal to a younger generation with mounting student debt.

Changes to retirement and pensions could also be on the horizon in 2020. The Senate counterpart of the SECURE Act is RESA, The Retirement Enhancement and Savings Act, which was reintroduced in March and awaits a vote. The most notable provisions in RESA include automatic enrollment credit for small businesses where employers offset start-up costs for new 401(k) plans and SIMPLE IRA plans that include automatic enrollment and a unique component that would allow small businesses to band together and creat open mulitple employer plans (MEPs), rather than offering a plan alone or requiring a 'common bond' between employers as under current law.

State employee benefits like health insurance and PTO aren't going anywhere. However, there will likely be a shift toward more perks that impact employees' day-to-day lives. Student debt repayment, childcare, extended PTO, fertility treatments, pet health care, retirement planning, and gym membership plans are all examples of issues that employees tackle on a daily basis that employers have stepped in to help alleviate.

Companies are also turning to 'flashy' benefits and perks like unlimited snacks, daily yoga, and foosball tables over traditional employee benefits in an attempt to appeal to millennials and Gen Z workers entering the workforce. However, according to a survey by staffing firms Robert Half International, workers are partial to familiar staples like flexible work schedules (88%), bonuses (77%), and health insurance (69%), while amenitites like an on-site gym or child care (38%), or paid time off to colunterr (31%) draw less attention. MIT reports that, contrary to the stereotype, millennials and Generation Z are not more likely to be motivated by flashy perks than their older colleagues.

The administrators and staff at BPA work around the clock to track and understand the latest in benefits and employment policies. For more information on upcoming policy changes, benefits administration, or how you can work with BPA, please contact us. Be sure to chack out BPA Executive Vice President Zane Dalal's published article in HR.com about how HR professionals can prepare amidst policy uncertainty.

Happy Holidays from BPA Benefits

We at Benefit Programs Administration wish all our colleagues and friends a wonderful holiday season with a Merry Christmas and continued success in the coming New Year.

We cherish the long-lasting friendships we have been privileged to form, and we look forward to the new friendships that are yet to come.

From our BPA family to yours,

Happy Holidays!

Lili Gaspar: Don't Let Fear Stop You From Exploring Your Potential

I started my journey at BPA in the call center, answering phones for union representatives about benefits, eligibility and other related questions for participants. I traveled to open enrollments and provided support wherever it was needed. Then, during the early 2000s, we began growing very rapidly and the service demand was high, so my manager suggested I become a lead, which transpired into being call center manager, and then moving on to claims manager. I’ve been very fortunate to work on both sides of the third-party administrator process and I feel like it makes me a better administrator for clients.

This shift was a difficult transition at first -- starting as a peer to my coworkers and becoming a manager -- and I had to gain the trust and loyalty of the staff over time. That was such an important factor for me because gaining that trust would grow into loyalty. I’ve learned that when you build trust among those you manage; they are happier and more willing to meet and exceed expectations. In 2017, I became an assistant administrator as a supportive role for administrators and then shortly thereafter transitioned into an administrative role. With that transition, I learned more of the backend in benefits approval instead of the client-facing roles I had previously held. I strongly believe my experience with the plan participants gave me better insight on this side of my career.

BPA has given me these incredible experiences and opportunities, allowing me to grow both personally and professionally. I’ve been able to flourish in every direction, which has allowed me to try out courses in various areas of benefits administration, one in particular being claims. The mentorship and guidance I received while starting at BPA really went a long way and shaped me into becoming the best I knew I could be. Lance was a great mentor of mine when I first started at BPA and I’ve continued to follow his advice while growing within the company.

No matter what direction an employee wants to take, BPA really encourages them to explore those opportunities and reach for every goal. Before going out to the general public to find an individual to fill an open position, they’ll look in house to see if someone within BPA is a better fit. Everyone here gets the chance to explore their own potential.

Many women in the workplace don’t get the same opportunities. Some feel as though they need to blend in, do their job in the background, and avoid attention. That mindset can hold them back from reaching their true potential. It’s important that women within a company or industry, regardless of what that may be, speak up, express what’s on their mind and advocate for themselves. Confidence is key and advocacy for yourself and for other women will go a long way in creating change.

When it comes to growth or change, it’s crucial to seek out mentors who can help. Employers can foster this type of environment, striving to be a mentor and a coach to those they oversee by motivating employees to do better, teaching employees how they can improve and giving them more learning opportunities for everyone, not just women in their workplace.

Unions can and have been advocating for women in the workforce by giving them a platform to grow and build from. Women used to be a minority in the workforce and unions were a big part in opening the door. Many female-focused benefits became a more widely accepted policy in the non-union workplace once unions took those first leaps. The women’s movement, in particular, really brought family and maternity leave to the forefront as mainstream policies.

Today, it’s important we continue to push for workers’ rights and benefits including more time with families and newborn babies, men asking for more paternity leave, and so on. If it’s not you needing this extra time, it’s someone you know. People are very quick to assume “it’s only me,” or “I can’t do it” when it comes to creating change or making an impact. There is power in numbers, and there’s no better proof of that than seeing the achievements made by unions.

Building Trade News: Why a TPA is the Smart Way to Go

In this month's issue of Building Trades News, BPA Executive Vice President Zane Dalal highlights the benefits of partnering with a TPA.

Denise Wampler: "It's All About Balance" - November 20, 2019

Women comprise 47 percent of the U.S. workforce and have fueled 51 percent of the workforce growth in the past ten years. At BPA, we stand behind gender equality in the workplace and seek to elevate women into leadership and supervisory roles. We believe that when we allow a diversity of opinions at the table, our organization flourishes. BPA’s Women in the Workforce is a monthly blog series featuring female employees from the BPA team discussing their personal challenges and triumphs in the workplace. Each woman offers her own insight into how to overcome these challenges, how impactful the support of women can be and how employers can help combat the problem of inequality at work.

Working for BPA and the benefits industry in general is very gratifying. Helping people understand their healthcare and pension plans is very rewarding. It’s great to see them connect the dots, that the portion of their paycheck is taking care of their healthcare or contributing towards their future years. Unfortunately, younger people don’t realize that over time, their contributions add up. Some people who put aside a portion of their paycheck throughout the years, can retire quite well now.

In my opinion, the biggest challenge women face in the workplace is dropping the paradigm of the “carrot stick” management style – a combination of reward and punishment - it’s not working. Women bring connection, while men are very objective – it is a balance that is necessary to empower one another. In this industry, a nurturing and caring nature is important to communicate about the long-term effects of the benefit plans we administer. Quite of few of the ladies I work with the various departments (i.e. customer service and pension) have very nurturing personalities and able to put members at ease when they call incredibly worried.

Another area that women need to focus on is: working with each other instead of in competition with one other. By empowering supportive female relationships, there have been links to higher workplace happiness, lower rates of depression and lower employee turnover. The leadership at BPA is great at creating a collaborative environment and that is has been key to the longevity of our employees. The owners are mindful about promoting from within the ranks, thus allowing people with experience to lead the various division effectively.

My advice to other employers: Focus at your employees’ strengths and assist them to overcome their weaknesses. At BPA, the owners have been very good to provide tools for leadership growth, be it software, classes or training. Also, providing other incentives such as college tuition, leadership training is advantageous for keeping the employees working at their best.

My advice to women: never stop learning from each other and pass on the experiences you’ve been given. Take a look at what our mothers went through. They encouraged and uplifted our generation to shatter boundaries in the workplace. Now, we will assist our daughters (and sons) to continue to make the workplace and the world a better place for their children.

Unions and TPAs Serving America's Veterans - November 6, 2019

Benefit Programs Administration (BPA) stands with all of America’s veterans as they transition from military service to the private sector. Veterans returning to the workforce, like all workers, deserve fair pay and safe working conditions. They deserve access to the best benefits, job prospects and networking opportunities. After nearly 75 years of working with unions in the benefits industry, BPA has seen union membership offer many of these perks to help America’s veterans succeed after military service.

A significant protective program designed for veterans in the labor force is the Uniformed Services Employment and Reemployment Rights Act (USERRA), a federal statute that protects servicemembers' and veterans' civilian employment rights. This statute requires employers to put individuals back to work in their civilian jobs after military service. USERRA Advisor assists veterans in understanding employee eligibility and job entitlements, employer obligations, benefits and remedies under USERRA. However, USERRA is not the only assistance available to veterans after leaving the military.

Service members tend to be quick learners, hardworking, personally responsible and selfless, still, many of them have trouble attracting the attention of hiring managers. A recent article by The Hill expressed the overlooked need for veterans in the labor market. High-quality skills expected of military veterans include teamwork, leadership, structure, commitment, reliability, and punctuality. However, the years of firsthand experience that directly translate into IT, security, manufacturing, logistics, or managerial positions are typically overlooked by hiring managers. It is not a lack of knowledge, but a lack of communication between businesses and veterans causing this discourse. But with unions, veterans bring valuable benefits as a labor pool; for veterans, unions bring a rich network readily available to use and expand their knowledge and skills. Unions bring a network that connects veterans to the right people.

According to a study from the Institute for Veterans and Military Families at Syracuse University, veterans are more likely to seek out a position from an organization that offers competitive benefits and provides education on how military skills carry over into the workplace. Roughly 16 percent of veterans—or 1.2 million veterans—are in a union or covered by a union contract. Unions can help both veterans and nonveterans earn higher wages, obtain better benefits and assist with continuing education. On average, a worker covered by a union contract earns 13.2 percent more in wages and is much more likely to have health and retirement benefits than a peer with similar education, occupation, and experience in a nonunionized workplace in the same sector.

For veterans, union membership can be beneficial in more ways than just benefits. Union jobs often provide problems to be solved, possibly the chance to work with one’s hands, freedom from a desk, camaraderie and a sense of service. Depending on the job and experience, union members can earn over six figures a year, a healthy salary that eventually gives way to a robust pension.

After everything veterans have done for our country and our freedom, it’s only right that they gain access to fair wages, working conditions, and solid benefits, as well as a place they feel supported and enjoy working. Unions can help connect veterans to meaningful work with fair compensation, while also helping companies employ remarkable workers.

Veterans can rely on BPA for the administration of benefits plans through single or multi-employer trust funds. We work hard to earn your trust and work harder to keep it. Contact us to learn how you can partner with BPA to earn the effective benefits you deserve.

Judi Knore: "More Progress to be Made" - October 15, 2019

Women comprise 47 percent of the U.S. workforce and have fueled 51 percent of the workforce growth in the past ten years. At BPA, we stand behind gender equality in the workplace and seek to elevate women into leadership and supervisory roles. We believe that when we allow a diversity of opinions at the table, our organization flourishes. BPA’s Women in the Workforce is a monthly blog series featuring female employees from the BPA team discussing their personal challenges and triumphs in the workplace. Each woman offers her own insight into how to overcome these challenges, how impactful the support of women can be and how employers can help combat the problem of inequality at work.

Stop by exhibitor booth #908 at next week’s IFEBP Annual Employee Benefits Conference to chat with Judi Knore, as well as some of the other BPA women featured in our Women in the Workforce series!

Working for BPA, I feel like I’m a part of a family that is full of support and builds a nurturing environment. From the staff on the floor that interact with participants, to leadership, such as Hormazd, I’ve always felt at home here and I love working for BPA. I grew up in this industry – my father was a plan administrator and I saw what he did on a daily basis. I was hired 1993 as a pension processor and while working at different positions within the Company, have developed very strong relationships with both coworkers and the people I serve. Working as an administrator feels like something I was always meant to do; it’s in my blood!

As a woman in the workforce, I’ve never felt uncomfortable or out of place at BPA. I think because BPA is a family-owned business, we hold strong family values and management supports a balance of work and family responsibilities. As an example, I was promoted to Administrative Supervisor when I was seven months pregnant. Even in 2019, some women starting and growing their families struggle to continue to climb the ladder at work. However, my hard work has never gone unnoticed at BPA and I feel that I have been rewarded for my efforts.

Generally, women struggle to break through the “boys club” in the workplace. We feel like we need use sports-related ice breakers just to join the conversation. In some instances, women are seen as the domestic employees and are not given the same type of assignments as male employees. Fifteen years ago, while attending my first Board of Trustee meeting as an assistant administrator, a male attendee working in the industry asked me to get him some coffee during the meeting. At the time, it was much more uncommon to see women in meetings like that with an equal seat at the table.

On a positive note, recently we were reviewing investment reports with one of our clients when one of the male industry leaders noted that the key leaders in this particular fund were all men. He questioned why there seemed to be very few women on staff. It was enlightening to hear this perspective from a man who holds an industry power position voice this as a concern. We’ve come a long way in the last fifteen years, but there is still more work to be done when fighting for gender equality.

Employers can begin to address gender inequality in the workplace by being fully inclusive in promotions, day to day operations, and decision making. Everyone should get equal opportunities regardless of gender. BPA managed to prevent this issue by promoting from within the company. With the family aspect of BPA, everyone is recognized for hard work and people are recognized for that work – male or female.

The workplace in general is starting to open more doors and expand opportunities for women and we’ve come a long way since a decade ago, but there is still more to be done. Women have worked tirelessly in the past to be noticed and taken seriously in the workplace and some of those efforts have payed off. Women are deserving of equal opportunities in the workplace and employers should start advocating for us. I feel very fortunate to work at BPA where I am seen as an important and equal part of the company. I feel very at home here and I wish that feeling for other women in their place of work. With employees and employers working hand in hand for equality, I am certain we will get there.

Unions on the Front Lines Fighting Inequality - October 9, 2019

The 65th Annual IFEBP Employee Benefits Conference is just weeks away, and BPA is gearing up to head to San Diego. We’re excited to join industry peers to discuss important topics including gender equality, equal pay, the opioid crisis and mental health. While all of these topics span various industries, each of them has some root in combatting inequality. BPA has a longstanding relationship with labor unions who have been working to support their members in seeking equality in the workplace for decades.

Unions have been on the front lines of fighting inequality for decades. Due in large part to union involvement, the U.S. has created laws and regulations that prohibit child labor, allow for family and medical leave and enable employer-provided health care. Unions have been a catalyst for the ongoing civil rights movement, women’s rights, and closing the gap between rich and poor. Today, unions are continuing to fight for racial and gender equality, fair wages and treatment, and better working conditions. BPA is proud to work with union members every day. Especially in today’s political climate, BPA stands with their members to effect change politically and systemically.

Work mirrors many of the same issues that we face in society at large today. Therefore, unions have a unique position of being on the front lines to fight injustice and inequality, starting in the workplace and expanding beyond. In order to understand the value that union membership offers members now, it’s important to understand the history and impact of the organized labor movement.

Unions have been present in the U.S. since its founding. The earliest recorded strike occurred in 1768 when New York tailors protested wage reduction. The creation of the Federal Society of Journeymen Cordwainers (shoemakers) in 1794 is cited as the beginning of sustained trade union organization among American workers. Perhaps one of the most notable moments in union history was in 1866, when the National Labor Union was formed to convince Congress to limit the workday to eight hours. This marks one of the first successful union impacts on federal law. Since then, unions have continued to shape labor law and policy, such as:

The Fair Labor Standards Act - In 1870, the average American worked over 60 hours with no days off. Labor unions demanded shorter work weeks so that working-class people could spend time with their families instead of constantly working with no leisure time. The movement gained enough political momentum for the Fair Labor Standards Act to pass in 1937. The act limited the work week to 40 hours (eight-hour days), mandated workers be paid for overtime, and kept children under 16 from working during school hours.

The Family and Medical Leave Act - In 1993, labor unions brought forward the issue of time off work for matters such as a new baby, injury or illness, and other family obligations. Under the Family and Medical Leave Act, public employees as well as private sector workers who have worked for at least one year or 1,250 hours in the past 12 months are guaranteed 12 weeks of unpaid medical leave to care for themselves or their immediate family.

The Equal Pay Act - During World War II, more women began entering the workforce to replace the men who were fighting overseas. Despite working the same job, women were paid substantially less than the men they were replacing. The National War Labor Board endorsed equal pay for women for the duration of the war, but the initial Women’s Equal Pay Act failed to pass. The Women’s Bureau of the Department of Labor – along with an endorsement from Eleanor Roosevelt – helped the act to finally pass in 1963.

While workplace challenges have evolved, union members continue to be a driving force behind labor change. Just as unions continue to stand with workers, BPA continues to stand with its members to navigate the changing political climate and provide best-in-class counsel and support on benefits programs for members. Stay tuned to our blog and our newsletter for more updates on changes affecting our industry, and we will see everyone at IFEBP in October!

Dora Vele: "Support Goes A Long Way" - October 2, 2019

Women comprise 47 percent of the U.S. workforce and have fueled 51 percent of the workforce growth in the past ten years. At BPA, we stand behind gender equality in the workplace and seek to elevate women into leadership and supervisory roles. We believe that when we allow a diversity of opinions at the table, our organization flourishes. BPA’s Women in the Workforce is a monthly blog series featuring female employees from the BPA team discussing their personal challenges and triumphs in the workplace. Each woman offers her own insight into how to overcome these challenges, how impactful the support of women can be and how employers can help combat the problem of inequality at work.

I started working at BPA as a pension processor and have been with the company for 29 years. Throughout those years, I’ve learned a lot and have gotten support from leadership. BPA shows confidence in their people, and I’m proud to be a part of this company. In an environment like this, you can either sink or you can swim, and with the support the team receives from each other and our leadership, we are not going to sink.

Our CFO, Hormazd, has always been positive and supportive while helping female employees grow within BPA. In 2015, he presented me with the opportunity to be an administrator. I feel like I can continue to grow here with advice from great male and female mentors who are always happy to help. Everyone, from leadership to peers to trustees, were very supportive when I became an administrator. Many of them knew who I was and knew I previously worked behind the scenes at BPA. The support and appreciation for my hard work felt very rewarding.

I think the biggest challenge for women in the workplace today the boys’ club that still exists in some workplaces. These informal clubs where men wield power through their shared connections or backgrounds can understandably damage the confidence of working women. In some places, women have a harder time proving themselves and proving that they can do the same work as a man, but BPA doesn’t have this mentality-- we give both men and women equal opportunities to grow and succeed.

Professionals can help combat these types of issues. Unions are still evolving and pushing for new regulations in the industry. Some new companies are hiring more women in leadership roles, but there are still mostly men in those seats. Women are starting to make it to the top and hopefully over time, companies will start changing more rapidly for the better -- for women.

Benefit Trends Ahead: What HR Professionals Can Watch For In 2020 (HR.com) - September 30, 2019

The shifting policical landscape could bring large changes to the human resources and benefits administration industries. BPA Benefits' executive vice president Zane Dalal published an article in HR.com about how HR professionals can prepare amidst policy uncertainty.

An excerpt from the article can be found below.

The benefits landscape is ever-changing. It is a challenge for human resources professionals and benefits fund administrators alike to navigate the moving goal-posts of our industry as policies and requirements — such as individual mandates, new required minimum distributions and taxes on student loan benefits — change. From a legislative perspective, HR professional and administrators can expect changes that drastically affect the benefits industry over the next year, each bringing their own changes our industry should watch.

Supreme Court Rulings

In October, the Supreme Court will begin hearing cases for the 2019 term. This term, the justices will hear two pension-related cases.

What Employers can Expect from the New Generation of Workers: Trends in Gen Z Workers - September 10, 2019

Just when employers feel like they’ve learned how to cater to their millennial employees, a new challenge arises: what to expect from Generation Z.

The “Gen-Z” group, born in or after 1997, will outnumber Millennials in 2019. The oldest of the group are around 22 years old and are just entering the workforce. Almost half of Generation Z is non-white, making them the most diverse generation to date.

Just now entering the workforce, Generation Z will make up 40 percent of the working and consumer population by 2020. This generation already has a reputation for being hard workers and take responsibility for their career. Gen Z is more than willing to put in extra hours if they will be rewarded for doing so. They’re competitive and want to be judged by merit but prefer to work independently.

The newest generation to the workforce is deeply driven by security. Skill development and self-improvement are a big priority for these employees, as well as money and benefits. Up to 70 percent of Gen Z workers say salary is their top motivator, and that their top “must have” benefit is health insurance. Additionally, 35 percent of Gen Z plan to start saving for retirement in their 20s. These employees also expect work phones and laptops and expect texting and instant messaging to be essential to workplace communication.

Gen Z has an unprecedented digital connection – even more so than Millennials. They have never known life without technology at their fingertips, and use five screens on average: a smartphone, TV, laptop, desktop and iPod or iPad. A whopping 96 percent of the generation owns a smartphone, and more than half spend at least ten hours a day on an electronic device. However, Generation Z places high value on face to face interactions. These employees don’t just want to work for their employer – they want to be coached by their employer as well. Social experiences in the workplace also hold high value, which makes culture a key point for recruiting and retention.

Dubbed as the “We Generation”, Generation Z is the most advocate-friendly generation thus far. Born in the years right before and after 9/11, experiencing gun violence from a young age and coming of age in a time of political discourse, they are more likely to be politically active, and frequent businesses with socially responsible values. These employees expect no less from their employers.

Employers prepared to provide a positive day-to-day working experience with competitive conversation and quality personal and professional development will do well in welcoming Generation Z into the workforce. At BPA, we train our administrators to work with all generations of employees. We work daily to build lasting relationships with plan participants, and tout state of the art technology to keep employees and employers in the loop with their benefits year-round.

Annette Beatty: "Working Your Way Up" - September 4, 2019

Women comprise 47 percent of the U.S. workforce and have fueled 51 percent of the workforce growth in the past ten years. At BPA, we stand behind gender equality in the workplace and seek to elevate women into leadership and supervisory roles. We believe that when we allow a diversity of opinions at the table, our organization flourishes. BPA’s Women in the Workforce is a monthly blog series featuring female employees from the BPA team discussing their personal challenges and triumphs in the workplace. Each woman offers her own insight into how to overcome these challenges, how impactful the support of women can be and how employers can help combat the problem of inequality at work.

BPA is a great company where I’ve been employed for the last ten years. I’ve seen the potential this company has, including the many opportunities to grow, which I’ve already experienced myself. We’ve gotten better at adapting to changes in the industry and improvement in available technology.

So many women in the workplace are still lacking in confidence, struggling with the gender wage gap and equal pay, or not supporting other women. BPA is supportive of women in the workplace, employing and advancing women and providing greater opportunities. As a result, we at BPA are able to avoid many of these concerns. Unfortunately, that is not the case with all employers.

Employers can make a decision to level the playing field for women in the workplace. Actions such as women’s empowerment initiatives can provide opportunities for women to take on leadership roles and gain valuable management experience. Results of these programs include better company morale, more projects that require and encourage teamwork, continuous encouragement and support for women, more feedback and recognition, an increase in pay and better job titles, and more opportunities for growth.

Through my years of experience and building more relationships at BPA, I’ve become well-regarded in the benefits industry and have begun to build a name for myself, thanks to the opportunities awarded through BPA. My clients and colleagues trust me and enjoy working with me. I’ve also been able to branch out and take on new business roles and responsibilities that I wasn’t doing previously. The support of other women and my supervisors at BPA has allowed me to grow within the company, starting from data entry and working my way up to processing and then up to administration.

Because of this support, I’ve been able to attend board meetings and become exposed to the decision-making and accounting aspects of BPA. These changes have allowed me opportunities for development, more exposure to different courses, and the ability to network with employees who go to the annual employee benefits conference for the International Foundation of Employee Benefit Plans (IFEBP). In addition to the great relationships I’ve formed, I can continue to collaborate with the team, while also working with seasoned administrators.

BPA has been a strong advocate for female employees and is an industry leader in advancing women in the workplace. We see some of the same characteristics in of the unions we work, many already have a fair pay structure and emphasize finding the best employee for the job, regardless of gender.

However, I understand that a lot of women aren’t afforded the same support and unbiased pay structure. Employers looking for ways to support women in their businesses should become stewards that help represent employees if women don’t feel comfortable representing themselves, give general support to help women grow in the workplace, and ensure their female and male employees are being paid the same wage for identical work.

I have been fortunate to spend my career growing and learning at BPA. It’s afforded me opportunities I don’t think I would have had otherwise, and there’s a great support system here. I really encourage women to find their own support system among peers and leaders. My advice for women looking to advance in the workplace? Surround yourself with people who want to see you grow.

Can Benefits Reduce Employee Stress (HRCI) - August 15, 2019

The HR Certification Institute (HRCI) interviewed top benefits administrators, including BPA Benefits executive vice president Zane Dalal, in an article examining the correlation between company benefits and the stress levels of employees.

An excerpt of the article is below.

U.S. workers continue to report increasing stress levels, and anxiety-related issues affect an estimated 40 million adults annually. However, these disorders often go undiagnosed or untreated. This means you probably have employees who are suffering from stress and anxiety.

The good news is that you can help. Through comprehensive and unique benefits packages, you can reduce your employees' stress load.

Read the full article here.

Low Cost Benefits of Paid Time Off - August 14, 2019

Paid time off (PTO) is considered to be a monetary benefit that adds to an employee’s compensation package. More and more employers are implementing benefit packages that include a generous amount of paid time off, and by doing so, they’re recruiting better employees, retention rates are higher, and productivity in the workplace improves significantly.

By employing PTO, companies make quality employees feel happy, appreciated and motivated. When employees are happy, they tend to have increased performance and creativity. Their quality of work improves and they pay more attention to detail.

Although PTO is considered a benefit for the employee, there are just as many benefits for the employer. In most cases, the benefits of paid leave outweigh the expense. Payroll costs tend to be fixed, so that employers who offer paid leave will typically not see additional expenses from month-to-month. Increased morale also improves workplace safety, as employees tend to be less distracted and focus more on safety rules and the task at hand. PTO also decreases the amount of unscheduled absences from work, which gives employers greater predictability and the ability to plan work based on who will be in the office.

A research group called Project: Time Off created a study where employees rated paid vacation as the number 2 most-important benefit, after health care. Employees working in an environment that encourages vacations are more likely to use all of their vacation time (77 percent compared with 51 percent). However, the study found that employees who reported encouragement to take vacation from their employers (68 percent) are much happier with their jobs than those who work at places where either vacation is discouraged or managers are ambivalent about taking time off (42 percent).

Companies are starting to target younger generations entering the workforce when it comes to new hires. Millennials are prioritizing generous benefits over other services and perks. Project: Time Off’s study found that millennials use a greater proportion of their days for travel than Generation X or Boomers. Implementing generous PTO policies will be more appealing to young job seekers and create competition among companies who don’t offer PTO, or companies who offer a standard 10 paid vacation days per year.

Not all employees enjoy taking a luxurious vacation somewhere warm and tropical for two weeks out of the year. Some choose to take a staycation, or a “mental health day” to simply stay at home and recharge after a difficult work week. After doing so, they return to work more energized and motivated. If employees must wait an entire year to get a week of vacation, they’re more likely to feel burned out, their productivity decreases, and they may lose interest or passion for their job.

Taking time off work for mental health care is still a stigmatized practice, which might explain why half of employees use their PTO for mental health days, but say they don’t report them as such to their boss. Nearly a quarter (24 percent) of U.S. employees surveyed say their biggest vacation using PTO last year was a staycation at home. Mentally healthy employees have a healthy work-life balance. If employees don’t feel like they’re getting enough time off to recharge, they’re going to feel those effects both inside and outside of the office. PTO is a flexible option for rewarding employees and boosting morale in the workplace.

By giving employees generous or unlimited vacation days which include sick days, companies are avoiding an endless cycle of illness among employees. Research shows that 69 percent of workers don’t take sick days even when they are really sick, which puts coworkers at risk. Workplace illnesses cost employers $160 billion every year in lost productivity. It’s important for employees to feel like they can use their time off when they’re actually sick to avoid an illness spreading cycle.

At Benefit Programs Administration, we deliver outstanding services with personnel who are passionate about a healthy work environment and putting people first. BPA is proud to work with companies and union representatives to manage benefit plans for union workers. Whether you are just starting a group plan for your employees, self-administering a plan, or currently employ administration that may not have the proper skills, BPA can help you find the best solution for your plan and its members.

Selene Calderon: "You Have to Believe in Yourself" - August 8, 2019

Women comprise 47 percent of the U.S. workforce and have fueled 51 percent of the workforce growth in the past ten years. At BPA, we stand behind gender equality in the workplace and seek to elevate women into leadership and supervisory roles. We believe that when we allow a diversity of opinions at the table, our organization flourishes. BPA’s Women in the Workforce is a monthly blog series featuring female employees from the BPA team discussing their personal challenges and triumphs in the workplace. Each woman offers her own insight into how to overcome these challenges, how impactful the support of women can be and how employers can help combat the problem of inequality at work.

I started working with BPA right out of high school, came up in this industry and was mentored in the workplace. When I started with BPA, there was one female partner who tried to join the other male partners for lunch at a nearby club, but they wouldn’t let her in because she was a woman - even in 1986 California! It’s been a systemic issue; sometimes, older male generations will look right past you to the man sitting next to you, even though you’re the one doing the work.

Today, I feel a great deal of pride and fulfillment to be able to see the positive strides made since the beginning of the company. Thanks to Zane, Hormazd, and the mentorship of my peers, I’ve been able to grow into a Vice President role at BPA. These people make me feel respected, realizing that I’m trusted and appreciated each day. Everyone has a voice and everyone’s opinions are not only heard but sought after. However, I also realize not every woman feels this way at work.

I think one of the biggest challenges women currently face in the workplace is not seeing their own potential or abilities. Women do not feel empowered in the workplace and do not receive the mentorship or tools they need to pursue their goals, dreams and new endeavors. Although there is always room for growth and improvement, there is more potential than one would recognize. This struggle dates back as far as 1978 when Pauline Rose Clance and Suzanne Imes studied the “impostor phenomenon” in high achieving women. They found that societal gender stereotyping appeared to contribute significantly to the development of the impostor phenomenon. Women are far more likely to feel like their accomplishments are attributed to luck, instead of their own ability.

Women are still struggling today to feel empowered in the workplace and embracing their confidence. A major enabler of this problem in my opinion is social media. These new media platforms give off a false reality that everyone else is doing better, being better, looking better -- but in reality, not everything, including the bad, is being shared. As the senior women in the office, we have a responsibility to help the young women just starting their careers understand that they add value to the company and to the industry. If they’re willing to break out of their shell, they can progress and grow into higher positions. I want to return the mentorship I’ve received to future generations of women, giving them the tools and resources to continue growing in this industry and in their lives.

Thankfully, there is an increase in unions advocating for women’s issues, just as there is an increase in women’s membership overall. The Office and Professional Employees International Union (OPEIU) trust funds – which are predominantly female – represent women in the workforce. No matter what the position, they’re advocating for women to have working wages and benefits that support their families. Today, there are even women in traditional male trades. Unions have opened their arms to females and continue breaking down barriers.

Working in the benefits administration industry, I’ve witnessed an industry that was once dominated by male administrative positions, transform into an industry with more female administrative opportunities. Today, women are making big decisions and contributing to the growth of the organization. From my own experiences and personal growth, I’d like to tell all females -- don’t be afraid to go to a board meeting because there are all men in the room. My advice for women looking to advance? You know what you know, and you have to believe in yourself.

An Update on the Opioid Crisis - July 23, 2019

Every day, more than 130 people in the United States die from an opioid overdose. It’s the deadliest drug epidemic in the modern era. Fortunately, unions are continuing to step up in force to fight for their members. Unions fight for the wellbeing of workers on the job, however, that commitment must not only focus on the physical aspect, but also the mental aspect of workers. Employee mental health can be even more long-term than any physical injury and that includes an addiction to opioids.

Construction is a significant work environment prone to injury and addiction and the overdose rate is seven times greater than for the general population. According to Jill Manzo of the Midwest Economic Policy Institute, the opioid epidemic in the Midwest construction industry cost an estimated $5.2 billion in 2015. Each construction worker with an untreated substance abuse disorder costs an employer $6,800 per year in excess healthcare expenses, absenteeism, and turnover costs. But when a construction employee is in recovery from a substance abuse disorder, lives are saved and contractors save nearly $2,400 per year. The construction industry has some of the oldest multi-employer plans in the country and BPA has served construction workers from the very beginning.

Additionally, auto plants continue to be prime working environments for addiction. Repetitive and physically demanding labor often leads to injuries followed by chronic pain. Generous medical plans with low-cost drug pricing, on top of the lack of knowledge many doctors have regarding the serious addictive qualities of these drugs, creates problems for many union members, not just auto workers.

However, the UAW is making the treatment and prevention of opioid misuse a top priority on their list of issues during this year’s contract negotiations with the Detroit 3. Many feel that the issue demands that unions get involved and combat this issue in a positive way. A strong partnership between the unions and the companies are just one step in the right direction to saving lives.

Unions are continuing to combat this crisis through assistance programs, peer advocacy training, courses about substance abuse, and training on proper use of Narcan. The National Institute on Drug Abuse (NIDA) reports that more unions are utilizing employee assistance programs (EAP) that offer counseling and short-term assistance for people needing help with drug and/or alcohol abuse. EAP services have helped workers transitioning back to work after an absence for addiction treatment programs or services.

Union programs are gaining traction, and more research is being done to end the opioid crisis. The National Institute of Health (NIH) is joining private partners to launch an initiative in three scientific areas: developing better overdose-reversal and prevention interventions; finding new, innovative medications and technologies to treat opioid addiction; and finding safe, effective, nonaddictive interventions to manage chronic pain.

Additionally, some important labor relations guidelines to be aware of include disability being a protected class and can apply to members who are addicted to opioids, employee benefit programs that help members affected by the opioid crisis, and opioid abuse resulting from treatment of a workplace accident can be a covered “consequential condition” and, if so, treatment is free to the member.

Though the crisis is far from over, important measures have been taken and the situation is slowly, but surely, improving.

The Importance of Employee Mental Health - July 16, 2019

It’s no secret that a productive work environment stems from happy employees. For most Americans, a large part of their daily lives is spent at work. According to Mental Health America, less than one third of Americans are happy with their work. Not only does this decrease productivity from employees, but it also puts employees’ long term mental health at risk. In order to improve productivity in your business, there must be an awareness and understanding of the workplace environment and how it can be adapted to promote better mental health for your employees.

There are many different reasons why employees are unhappy with their work environment. Some of those reasons include minimal wage growth, lack of opportunity to advance, lack of teamwork and unhealthy co-worker relationships, excessive labor or hours, and poor management and communication practices. These factors add a strain to employees’ wellbeing and the day to day lives outside of work, too.

Smaller businesses may feel the financial hit even harder when impacted by poor employee mental health because there are fewer resources and employees to prevent or manage these problems. An increase in mental health problems for employees can affect businesses by an increase in absenteeism, conflict, turnover, loss of productivity, increase in cost, greater risk of accidents, injury, or incidents, and burnout.

Fortunately, there are ways your business can promote a healthy work environment for its employees and reduce the risk of negative mental health. First and foremost, understand the opportunities and needs of individual employees and develop better policies and emotional support. World Health Organization recognizes that interventions in the workplace can also protect and promote mental health, which include implementing and enforcing health and safety policies, involving employees in decision-making, encouraging a work-life balance, creating programs for career development and growth, and recognizing and rewarding the contribution of employees.

At Benefit Programs Administration, we deliver outstanding services with personnel who are passionate about a healthy work environment and putting people first. We have a proven record showing trustees can count on us. We’ve built long lasting and trusted relationships with our employees, trustees, and partners, and with the support of our responsive customer care team we offload complex, time-intensive plans so our trustees can manage healthy time management.

A happy workplace makes for happy employees! Trust is one key factor that builds strong relationships in the workplace and strong relationships make for a great TPA. Contact us to learn how you can partner with Benefit Programs Administration to build the trust that propels and motivates workforce and healthy employee mental state.

Working For You: A Day in the Life of Your Benefits Administrator - July 9, 2019

Benefits administrators provide human resource services and advice for both employers and employees within a unionized organization. They manage the directing and planning of all day-to-day operations of a group benefits program for unionized workers. This includes group health, dental, vision, worker’s compensation, short-term and long-term disability, travel and accident plans, life insurance, flexible spending accounts, health savings accounts, 401(k) plans and other retirement options.

The Taft-Hartley Act reserved the rights of labor unions to organize and bargain collectively. Under the Taft-Hartley model of a union/multi-employer-based benefit plan, a benefits administrator must know and follow company policies, state regulations, and federal laws. They must stay up-to-date with any policy or regulatory changes, respond to problems, prepare reports, and develop relationships with employees and vendors to do their job well.

BPA is proud to work with companies and union representatives to manage plans for union workers. Our committed staff is focused on providing best-in-class service to workers and offering valuable insight on developing regulations to employers.

Lance Phillips is a Vice President and Administrator at BPA, and has worked with BPA for 30 years. An invaluable member of our team and trusted administrator to his clients, Lance exemplifies the high-quality customer service that BPA provides.

We sat down with Lance to understand how he feels he best serves plan members, regulation changes and more about his typical day at BPA.

What does a typical day-to-day look like? Or is it quite varied?

It varies. Depends on the time of year, the month, the quarter. On an annual basis in the fall, all of the health and welfare plans offer open enrollment to the participants. So, in September you’re working on open enrollment meetings and compiling information materials for participants. In October you’re sending those things our and requesting a response, then of course you receive the response and need to act accordingly. You work on behalf of the employees, as a liaison with new providers and a board of trustees, adjusting benefit categories - new vision/dental, etc. - and more. But it tends to come in cycles. Open enrollment is just one example.

How has the job changed since you first started?

Technology. There’s been an evolution from doing most work through the telephone to working through email. Providing data through email. Previously data came through a package, then fax, and now it’s all on the Cloud. Everything’s more immediate, but I think it’s for the better. It allows us to act quickly to better serve our participants.

How do regulation changes affect how you work?

The Affordable Care Act had a huge impact on all of the health plans administered. Regulatory changes are always ongoing with retirement plans. How is the PBGC going to survive when you have a lot of these plans that are under-funded? The BPA team reads the information that’s provided in the mainstream media and works with professionals – legal professionals, actuaries, consultants – to get into the nuts and bolts and what affect the legislation has on plans. How do we comply? How do we communicate the changes? BPA plan administrators are constantly learning and reacting to the changes that occur so that we can provide the best information and choose the best actions. It’s a team effort. We rely upon trust counsel to decipher the changes to the plans that we administer.

What would you say is the most important part of your job and why?

Being responsive. We aim to be as responsive as possible to other professionals by keeping them in the loop, answering their requests, managing participant requests and providing information, and being responsive to the companies we serve. When I think of administrators, we’re the quarterback. We need to make sure that everyone we’re working with on the team has the same mindset towards what needs to get done. Board of trustees, the company at large, and the staff internally.

The BPA benefits administrators are well-educated leaders in their field. BPA’s proven record is one that trustees, plan professionals, and participants have come to rely on. Whether you are just starting a group plan for your employees, self-administering a plan, or currently employ administration that may not have the proper skills, BPA can help you find the best solution for your plan and its members.

How to Attract and Retain Millennial Workers - July 2, 2019

The age definition of a “millennial” can vary depending on who you ask, but generally, millennials are defined as those born between 1981 and 1997. According to U.S. Census data interpreted by Pew Research millennials are set to soon overtake Baby Boomers as America’s largest generation.

As Baby Boomers and Millennials both age, America is seeing a greater influx of Millennial immigrants, giving the group an edge in outgrowing Baby Boomers.

Why does this matter?

Soon, millennials are going to be the largest generation in the workforce. They currently have the reputation of being disloyal “job hoppers” but they have been entering the workforce at challenging times, enduring three recessions in the last 20 years – 1998, 2001-2002, and the Global Financial Crisis in 2008.

Regularly, millennials chose to make compromises when entering the workforce, especially during the Global Financial Crisis. They saw their elders, who had for years been loyal to their jobs, laid off. Their peers were turned down for jobs that their education promised they would find. Most millennials at this point in their lives have had four jobs and will move around to advance their career.

Fostering Millennial Loyalty

In contrast to these misconceptions about millennials, they are actually extremely loyal workers. However, business owners must work harder to earn millennial loyalty and trust. As this group of workers age, they are prioritizing good benefits, saving for retirement, homebuying and debt payoff. They care more about benefits than employers have given them credit. Using tactics that appeal to millennials to market benefits packages and the services that accompany them will be a make or break for employers aiming to attract and retain millennial workers.

Use new enrollment and benefits technology to appeal to millennials. Millennials grew up with quickly evolving technology. Therefore, it’s important to them to have easy access to information and services. Leverage well-designed online platforms, mobile applications and service providers with good online user experiences.

However, keep it simple. While millennials love using technology to make their lives easier, they also expect a simple process to reach human, non-automated customer service associates. In a day and age where technology plugs people into a bombardment of information, no one wants to be bogged down by extraneous and complicated information or steps.

Allow for flexibility and customization in benefits packages. Millennials know that these days, one size does not fit all. A benefits package that can be customized can go a long way.